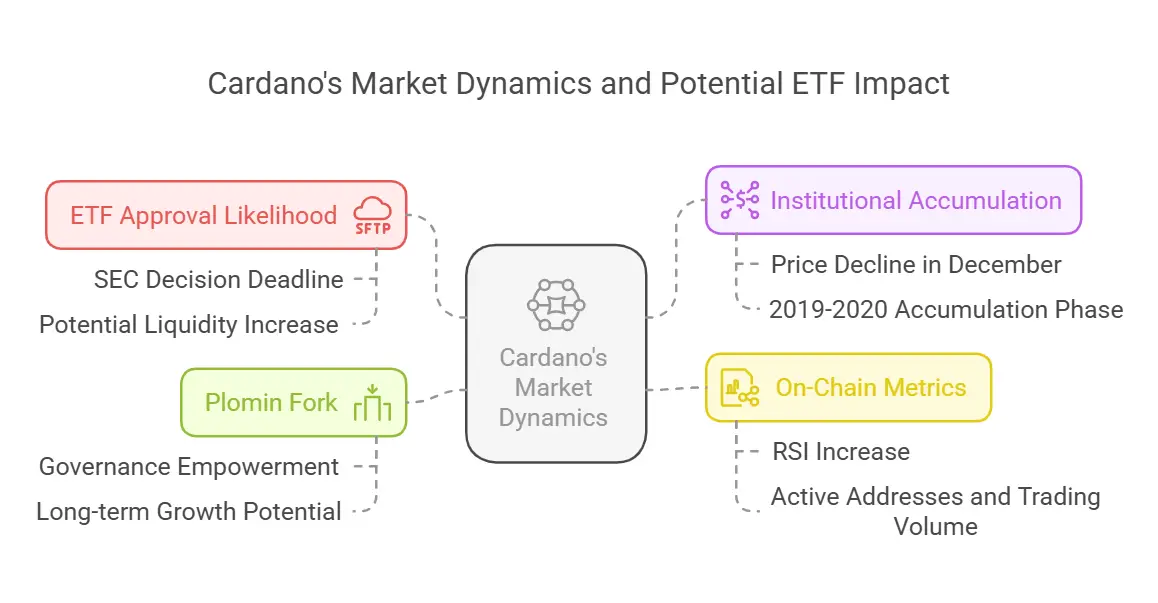

Cardano (ADA) has captured investor attention following Grayscale’s recent application for a spot ETF (Exchange-Traded Fund) on February 11.

Listen to the summary of this news:

The move signals growing institutional interest, with the New York Stock Exchange (NYSE) also showing increased enthusiasm for financial products related to Cardano.

Cardano ETF Approval Likely

Bloomberg has reported that there is a 60% probability of the U.S. Securities and Exchange Commission (SEC) approving Cardano’s ETF. Investors are closely watching March 27, the first deadline for the SEC’s decision. If approved, the ETF could bring billions of dollars in liquidity to the Cardano ecosystem.

Institutional Accumulation and Market Trends

Following ADA’s price decline in December, large investors have been steadily accumulating the token, anticipating a potential rally. Analysts note that Cardano’s recent price action resembles its accumulation phase in 2019-2020, which preceded its explosive 2021 bull run.

TapTools, a crypto analytics platform, highlighted in a post on X that ADA’s accumulation phase since 2022 mirrors its previous bullish cycles seen on weekly charts. Currently, Cardano is trading near the upper limit of its accumulation zone, signaling a potential breakout toward the $1 psychological resistance level.

On-Chain Metrics Show Increased Activity

Technical indicators also suggest growing momentum. The Relative Strength Index (RSI) for ADA has risen from 44 to 55, reflecting strong buying activity without signs of being overbought.

Moreover, blockchain analytics platform Santiment reports a steady increase in active Cardano addresses and trading volume over the past week, suggesting rising network engagement.

Cardano’s Plomin Fork and Future Potential

In addition to ETF speculation, Cardano’s Plomin fork has introduced advancements in decentralized governance, empowering token holders and reinforcing the network’s long-term growth potential.

Key Price Targets

With a potential ETF approval, strong historical patterns, and network upgrades, analysts believe Cardano could break the $1 resistance and target the next key level at $3—a price last seen during the 2021 bull market.

As institutional interest grows, all eyes are now on the SEC’s decision, which could determine whether Cardano’s next major rally is on the horizon.

Read More:

- From Boom to Bust: $LIBRA Token Plummets 90% In the Middle of Fraud Allegations in Argentine

- Tether Invests in Italian Football Giant Juventus, Expanding Crypto-Sports Collaboration

- Over 20 U.S. States Explore Establishing Cryptocurrency Reserves

- PAWS Token Set for Major Allocation Event : Here’s the Date

- Trump Meme Coin (TRUMP) increased 12%: Could It Outperform Bitcoin?

- Elon Musk’s New T-Shirt Sparks Role Controversy on Trump’s Administration

- Broccoli: The Latest Meme Coin to Rise Thanks to Changpeng Zhao

- Elon Musk Plays Dumb on D.O.G.E – Is He Secretly Controlling Trump Government?

- OpenSea Confirms NFT Market Airdrop, Prepares for Token Launch

- Four Airdrops to Watch in the Coming Week In the Middle of Crypto Market Volatility

- Best AI Crypto Tokens You Should Watch in 2025