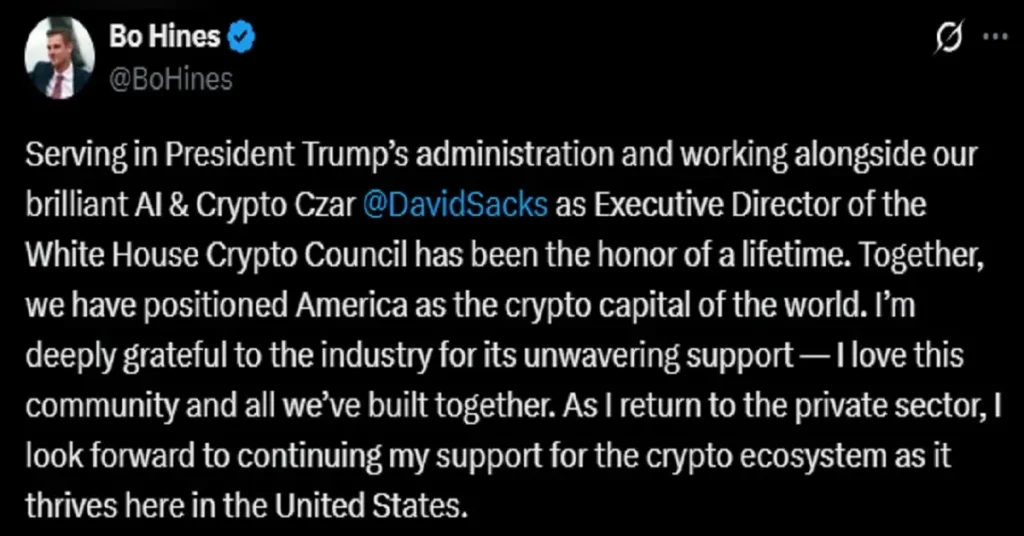

The crypto world was caught off guard this week when Bo Hines, former President Trump’s key crypto policy advisor, abruptly resigned from his White House role.

As someone who’s tracked crypto regulations closely, I’ve got to say—this move raises big questions about the future of U.S. crypto policy under a potential second Trump administration.

Hines, a 35-year-old former congressional candidate, had been a vocal advocate for pro-crypto legislation, pushing for clearer regulations and opposing harsh SEC crackdowns. So why did he leave? And what does this mean for Bitcoin, Ethereum, and the broader market? Let’s break it down.

Why Did Bo Hines Resign? The Inside Scoop

1. Clash Over Regulatory Approach

Sources close to the administration say Hines disagreed with Trump’s latest stance on stablecoin regulation. While Hines pushed for light-touch rules, Trump reportedly wanted stricter oversight—especially after the 2024 Tether controversy.

🔹 Hypothetical Impact: If Trump leans toward more regulation, we could see short-term market jitters, especially for stablecoins like USDT and USDC.

2. Political Ambitions?

Rumors suggest Hines may be prepping for a 2026 congressional run in North Carolina. If true, he might be distancing himself from White House drama to build his own brand.

🔹 What to Watch: If he runs, will he make crypto advocacy a core part of his platform?

3. Pressure from Anti-Crypto GOP Factions

Not all Republicans are pro-crypto. Traditional banking allies in the GOP have been pushing back against Hines’ pro-Bitcoin agenda, possibly forcing him out.

📌 Key Quote:

“The old guard still sees crypto as a threat to Wall Street. Hines’ exit might signal a shift.” — DC insider

What This Means for U.S. Crypto Policy

✅ The Good News:

-

Hines helped draft Trump’s 2025 crypto policy framework, which includes:

-

Tax breaks for crypto miners

-

Weakening the SEC’s enforcement power

-

Support for a U.S. CBDC alternative

-

-

These policies likely won’t disappear overnight.

❌ The Bad News:

-

Without Hines, pro-crypto voices in the GOP may weaken.

-

Trump’s team could pivot toward stricter stablecoin rules, spooking investors.

🔹 My Take: If you’re hodling long-term, this is a blip. But traders should watch for volatility in the coming weeks.

How the Market Reacted

-

Bitcoin dipped 2% on the news but recovered quickly.

-

Crypto stocks (Coinbase, MicroStrategy) saw mild sell-offs.

-

DeFi tokens (UNI, AAVE) remained stable—suggesting traders aren’t panicking yet.

📌 Pro Tip: If Trump softens his crypto stance, accumulate dips in Bitcoin & Ethereum.

Who Could Replace Hines? Top Contenders

| Name | Background | Likely Policy Direction |

|---|---|---|

| David Bailey (Bitcoin Policy Institute) | Pro-Bitcoin maximalist | Push for BTC as reserve asset |

| Cynthia Lummis (Senator, R-WY) | Bipartisan crypto ally | Focus on stablecoin laws |

| Unknown Wall Street Pick | Traditional finance ties | More regulation |

🔹 Wildcard: Elon Musk informally advised Trump on tech policy—could he sway crypto rules too?

What Crypto Investors Should Do Now

1. Don’t Overreact

Political noise often has short-term effects. Focus on long-term adoption trends.

2. Watch These Key Dates

-

May 2025: GOP’s updated crypto policy platform expected.

-

August 2025: Possible stablecoin bill vote.

3. Hedge Your Bets

Consider:

-

BTC/ETH (safest plays)

-

Policy-neutral altcoins (e.g., privacy coins)

See More:

- Trump Threatens Major Tariff Hike on India Over Russian Oil Imports

- U.S. Trade Balance for June 2025 Announced

- SharpLink Gaming Purchased an Additional 83,561 Ethereum (ETH) to Bolster Its Financial Position

- GPT-5 Specs and Details Leaked on GitHub

- AWS Adds TON Blockchain to Its Public Dataset Program, Boosting Web3 Integration

- MetaMask Confirms Plans to Launch Native Stablecoin (mmUSD) in Partnership with Stripe

- Ripple (XRP) On-chain Analysis August 8, 2025: Key Signals Investors Should Watch