What SPY (SPDR S&P 500 ETF Trust) is and its role in tracking the U.S. market, as analysis predicting a rise to $630-633 by August 29, 2025?

August 23, 2025 – The SPDR S&P 500 ETF Trust (SPY), a cornerstone of global investment portfolios tracking the S&P 500 Index, has been trending in financial markets, driven by robust performance and macroeconomic developments.

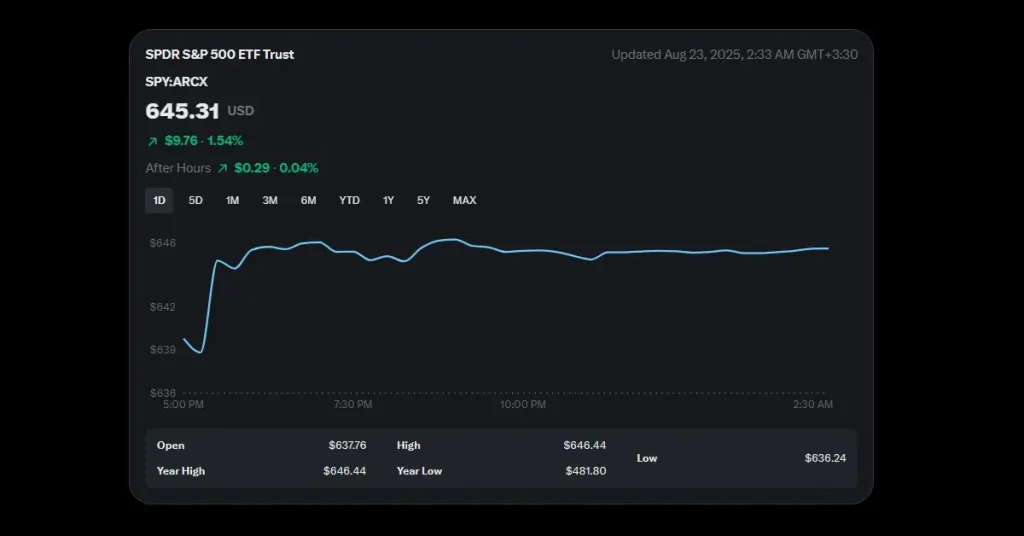

As of August 22, 2025, SPY closed at $645.31, reflecting a 1.52% daily gain and a year-to-date return of 10.44%. Over the past 12 months, the ETF has delivered a total return of 16.39%, with a five-year return of 104.02%, underscoring its appeal for investors seeking broad U.S. market exposure.

Market Drivers and Performance

The recent surge in SPY’s price, which hit a 52-week high of $646.50, coincides with heightened market optimism following Federal Reserve Chair Jerome Powell’s dovish remarks signaling potential interest rate cuts. This catalyzed a rally across major indices, with the S&P 500 and Dow posting significant gains. The decline in the VIX volatility index further supported investor confidence, reducing perceived market risk. SPY’s assets under management (AUM) stand at $652.78 billion, reflecting its status as one of the most liquid and widely traded ETFs globally.

Over the past month, SPY has gained 1.13%, with a three-month return of 13.02%, driven by strong corporate earnings and expectations of a softer monetary policy. Notably, 83% of S&P 500 companies have exceeded earnings estimates, bolstering the index’s resilience. However, concerns linger due to inflationary pressures, with the Philadelphia Fed Prices Paid Index reaching its highest level since May 2022, prompting some caution among investors.

Technical Analysis and Sentiment

Market analysts and traders on platforms like X have noted technical patterns influencing SPY’s trajectory. A potential rising wedge formation and a spinning top candlestick at recent highs suggest a possible short-term pullback, though bullish momentum remains dominant.

Analysts project a potential 10.44% upside over the next three months, with support levels around $6175 and upside targets as high as $6500–$6800. However, bearish divergence in some indicators, such as flat On-Balance Volume (OBV) and Supertrend, has led to speculation of sideways movement or a near-term correction.

Investment Considerations

With an expense ratio of 0.09% and a dividend yield of 1.11%, SPY remains a cost-effective vehicle for diversified exposure to large-cap U.S. equities, including top holdings like NVIDIA (8.21%), Microsoft (7.17%), and Apple (6.28%). Its high liquidity, with a 30-day average daily volume of 69.59 million shares, makes it a favorite among institutional and retail investors.

Outlook

As investors await further clarity from Powell’s upcoming Jackson Hole speech, SPY’s performance will likely remain sensitive to macroeconomic cues, particularly around inflation and Fed policy.

While the ETF’s strong fundamentals and market momentum support a bullish outlook, technical signals suggest caution for short-term traders. Investors are advised to monitor key support and resistance levels and stay informed on economic data releases.Disclaimer: Past performance is not indicative of future results. Investors should conduct thorough research and consult financial advisors before making investment decisions.